- admin

- June 3, 2024

- No Comments

Financial Goals Setting

Setting financial goals is an important part of becoming financially stable and safe in the long term. Having clear, achievable goals can help you stay focused and motivated while you save for a trip, a new home, or retirement. This article gives you tips on how to set and reach both short-term and long-term financial goals, which will help you build a solid financial future.

Importance of Setting Financial Goals

Financial goals help you decide how to spend and save your money by giving you direction and purpose. You can keep track of your progress, make smart financial decisions, and stay motivated to reach your goals if you set clear goals.

Benefits of Financial Goals

- Increased Motivation: Clear goals give you a sense of purpose and make you more likely to stick to your financial plan.

- Better Financial Management: Setting goals helps you use your money more wisely and avoid spending it on things you don’t need.

- Enhanced Financial Security: Reaching your financial goals can make your life easier and give you more peace of mind.

Strategies for Setting Financial Goals

Define Your Goals Clearly

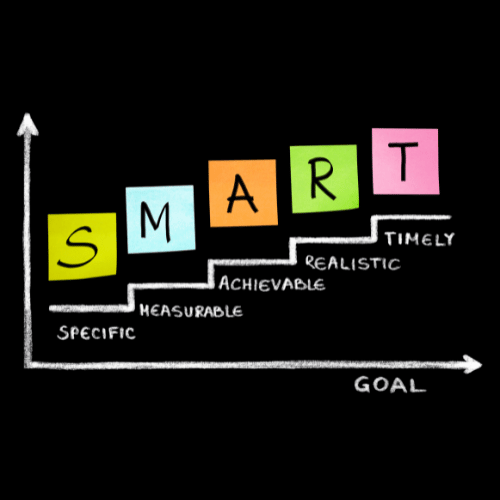

First, be very clear about what your financial goals are. Make sure your goals are SMART by making sure they are clear, measurable, attainable, relevant, and time-bound.

- Specific: Make it very clear what you want to do.

- Measurable: Set goals so you can keep track of your progress.

- Achievable: Set goals that you can actually reach.

Relevant: Make sure your short-term goals are in line with your long-term financial goals. - Time-bound: Give yourself a certain amount of time to reach your goals.

Categorize Your Goals

Your financial goals should be broken down into short-, medium-, and long-term groups.

- Short-Term Goals: These are things you want to do within a year, like saving money for a trip or an emergency fund.

- Medium-Term Goals: These are plans that will take one to five years to complete, like getting a car or paying off debt.

- Long-Term Goals: Are ones that you want to reach in more than five years, like buying a house or saving money for retirement.

Prioritize Your Goals

Sort your goals by how important and how quickly they need to be done. Focus on important goals that will have a big effect on your finances, like saving for an emergency or paying off debt with high interest rates.

Break Down Goals into Actionable Steps

Split up each goal into smaller steps that you can take. Now you can handle big goals better and keep track of your progress. For instance, if you want to save $10,000 for a down payment on a house, figure out how much you need to save each month to reach your goal by the date you choose.

Strategies for Achieving Financial Goals

Create a Detailed Budget

To reach your financial goals, you need a detailed budget. Keep track of the money you earn and spend, and put some of it toward your goals. To stay organized and on track with your budget, use tools and apps.

Automate Savings

Setting up automatic savings will make sure you keep working toward your goals. You can set up your checking account to send certain amounts to your savings account every month.

Monitor and Adjust Your Plan

Check in on your progress often and make changes to your plan as needed. Things can change in your life and your finances, so be flexible and make the changes you need to stay on track.

Cut Unnecessary Expenses

Find and get rid of expenses that you don’t need to free up more money for your financial goals. Look at how much you spend and see where you can cut back, like on eating out, subscription services, or buying things you don’t need.

Increase Your Income

If you want to make more money, you could get a part-time job, do freelance work, or start a side business. Your progress toward your financial goals can be sped up by making more money.

Stay Motivated and Accountable

For long-term goals to be reached, you need to stay motivated. To stay motivated, do things like celebrate small wins, picture yourself reaching your goals, or tell a trusted friend or family member about your progress.

Examples of Financial Goals

Short-Term Goals

- Building an Emergency Fund: Save enough money to cover your living costs for three to six months in case of an emergency.

- Paying Off Credit Card Debt: To lower your stress level about money and boost your credit score, pay off your high-interest credit card debt first.

- Saving for a Vacation: Put aside a certain amount of money every month to pay for your next trip.

Medium-Term Goals

- Buying a Car: When you buy a car, you should either save up for a down payment or pay off your loan quickly.

- Home Renovations: Set aside money to make changes or improvements to your home.

- Education Savings: Put money aside to pay for school, whether it’s for you or your kids.

Long-Term Goals

- Buying a Home: When you want to buy a house, you should save money for a down payment and plan for the costs of a mortgage and other home expenses.

- Retirement Savings: Put money into retirement accounts like 401(k)s and IRAs to make sure you have a good time in retirement.

- Investment Goals: To get rich over time, put your money into stocks, bonds, or real estate.

Conclusion

A big part of financial planning is making and reaching financial goals. You can reach both short-term and long-term financial goals if you set clear goals, make a detailed budget, and stick to it. Take a look at your finances today, make some SMART goals, and start putting plans in place to stay on track. You can protect your financial future and enjoy the peace of mind that comes with being financially stable if you are determined and consistent.