- admin

- May 2, 2024

- No Comments

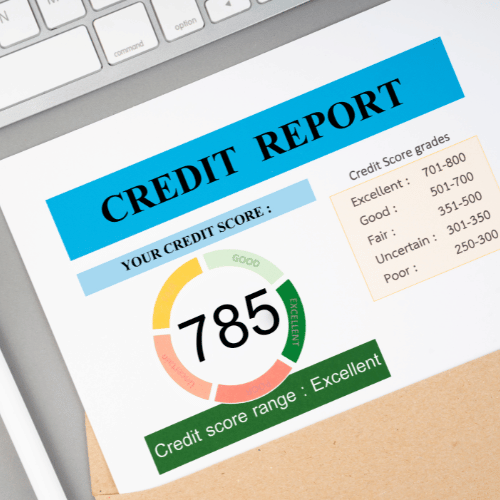

How Credit Builder Programs Can Transform Your Credit Score

Building or fixing an excellent credit history can be hard for many people, but it’s important to do it. A good credit score isn’t just a number; it’s an important part of your financial profile that affects everything from the interest rates you pay on loans to the types of loans you can get. People who don’t have much or any credit history often have a hard time getting loans and credit cards with good rates. This can make it hard to build credit if you don’t already have it.

Programs that help you build credit are made to break this circle. Through controlled, responsible money management, these programs give people a safe and organized way to raise their credit scores. People can slowly improve their credit score by learning how these programs work and making good use of them. This not only gives them more ways to make money, but it also gives them more power over their financial future.

Why is Building Credit So Important?

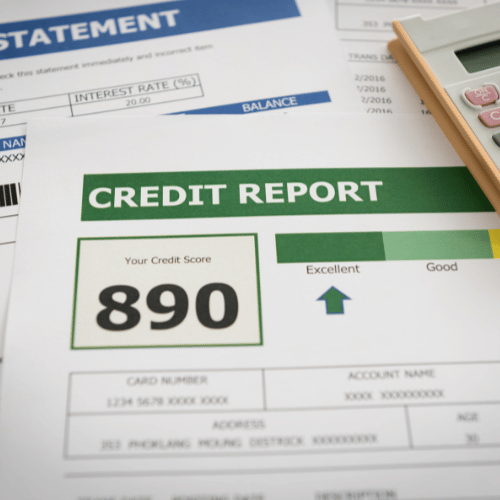

Many people may not think of credit as anything more than numbers on a page or a score given by an anonymous agency. However, these numbers have a big effect on many of the cash choices and chances you have. A good credit score does a lot more than just help you get loans; it has a huge impact on your whole financial life.

Lower Interest Rates on Loans and Credit Cards: Lenders will usually offer you cheaper interest rates if you have a high credit score because it shows that you are a low-risk borrower.

Increased Chances for Loan Approval: Lenders don’t just look at your income when choosing whether to give you a loan; they also look at how you’ve handled credit in the past. Having a good credit past makes it more likely that you will be approved for new credit.

Better Terms for Renting and Housing: Credit scores are often checked by landlords when they look at possible tenants. A better credit score can make it easier to get the housing you want and may even change the amount of the security deposit that is needed.

Utility Services: When you sign up for services like internet, water, electricity, or electricity, the company may check your credit. People with better credit might not have to put down a deposit, but people with worse credit might have to.

Employment Opportunities: Having a good credit history is seen as a sign of responsibility and honesty in many fields, especially those that deal with money. Credit checks may be part of the hiring process for people working in these areas.

What is a Credit Builder Loan?

The credit builder loan is a special type of loan that is used to help people build or rebuild their credit. It is at the heart of many credit-building plans. In typical loans, you get the money you borrow right away. Credit builder loans, on the other hand, work differently and have a specific goal: Improving your credit score.

Credit builder loans can be very helpful for improving your credit because they encourage routine and discipline, which are important for good money management.

How a Credit Builder Loan Is Put Together

You can’t get cash right away with a credit builder loan. The loan amount is instead put into a bank account that the lender controls and isn’t given to you until all of your payments are made. This setup may seem strange, but it gives you a safe place to show that you can handle money without having to worry about spending the loaned money.

How It Works

- Loan Agreement: When you agree to borrow money from a provider, the money is put into a locked account instead of being sent to you.

- Monthly Payments: This amount is paid off every month, and your payments include interest and maybe some other fees. Experian, Equifax, and TransUnion are the three main credit bureaus that get these fees.

- Completion of Payments: As soon as all of your payments are made, the total amount you saved is given to you.

Benefits of Credit Builder Loans

- Improves Credit Score: Making payments on time and regularly is a key part of credit score models. Your credit score can go up a lot if you can make these payments on time.

- Savings Component: You will have a better credit score and the loan amount at the end of the loan term. You can use this money to keep building your financial security.

- Low Risk: This is because the lender holds on to the given amount, so there isn’t much risk for either party. This setup makes it easy for people with bad credit or no credit to get approved.

Who Should Consider a Credit Builder Loan?

Credit builder loans are best for people who:

- Don’t have any credit history yet and need to start building it.

- Do not have good credit history and want to fix it.

- Are trying to find a safe way to show that they can pay back a loan.

Choosing the Right Loan

When picking a credit builder loan, think about these things:

- Interest Rates: Look at interest rates from several lenders to find the best ones.

- Fees: Know about any extra costs that come with the loan.

- Loan Terms: Think about how the loan’s length might affect your monthly budget and whether you can really make all of your payments on time.

How Does a Credit Builder Program Work?

A credit builder program is appealing because it takes a structured method to not only improve your credit score but also teach you good money habits that will last a lifetime. These programs were carefully made to help people one step at a time, making sure that there is a complete way to improve trustworthiness. Here is a more in-depth look at how these tools work and what they can do for you:

Mechanics of a Credit Builder Program

- Initial Setup: When you join a credit builder program, you agree to borrow money that you don’t get right away. This money is instead put into a safe savings account.

- Regular Payments: Then you start making regular monthly payments toward this amount for a set amount of time, usually 6 to 24 months. These amounts include both the principal and the interest.

- Credit Reporting: The credit companies are told about all of these payments. Your payment history is the most important factor that affects your credit score, so making payments on time every month can help.

- Completion and Funds Access: Once all of the planned payments are made, you can access the entire amount that has been saved. This not only helps your credit score, but it also saves you money, which makes you more likely to keep the money.

Enhancing Financial Security Through Credit Building

- Builds a Positive Credit History: Making payments on time every month helps your credit score go up by building a good credit history.

- Develops Financial Discipline: Making payments on time every month teaches you how to manage your budget and set spending priorities.

- Savings Accumulation: When the program is over, you can access the money that has been saving. This money can be used as an emergency fund or put back into other financial goals.

- Educational Resources: A lot of credit builder programs also offer educational resources to help you learn more about managing your credit.

Steps to Start Building Your Credit Today

Follow these useful steps to start improving your credit:

- Research: Look into different credit builder programs to find the best one for your budget. To get the best result, make sure that the program sends information to all three major credit bureaus at the same time.

- Apply: Fill out an application for a credit builder loan once you’ve finalized your program choice. As well as the interest rates and payment plan, make sure you understand the terms and conditions.

- Make Payments: Always pay your bills on time. In order to avoid missing payments and possible damage to your credit score, setting up automatic payments can help.

- Monitor Your Credit: keep an eye on your credit record and score. Another benefit is that it will help you figure out what you need to work on even more.

- Financial Discipline: Keep using good money management techniques. Pay down your debts, don’t spend too much, and keep your credit utilization low.

Conclusion

Credit builder loans are a good way for people with little or no credit history to slowly and steadily improve their financial situation.

Not only does making payments on time help your credit score, but it also helps you save money. Don’t forget that getting good credit is a run, not a sprint. It needs persistence, patience, and self-control.

Start today to build a strong financial future for yourself.